Audit of Charitable trust or NGO under section 12A (b)

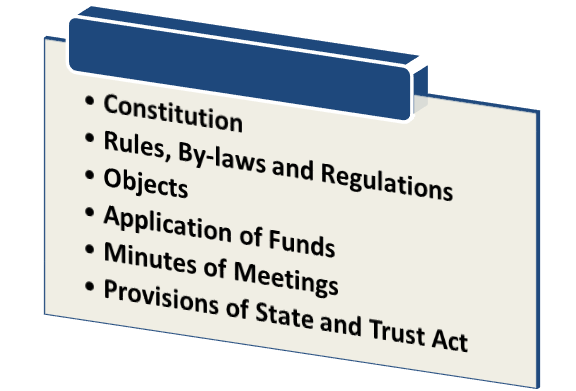

The main objective of auditing charitable institutions is to allow the assessing officer to convince himself concerning the genuineness of the privilege/exemption claim under section 11. It is even to verify if the trust has complied with qualifications guided by the law or ordinance. The accountant has to check the ‘balance sheet’ and the ‘profit and loss’ exhibiting an authentic and fair view. He should consider all the concerning compliance with the provisions of the Act by the institution in respect of the preservation of books of accounts, data, and returns from members and other related documents. He must check the following standards:-

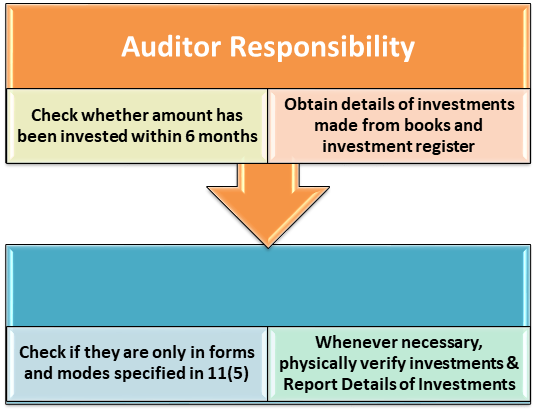

What are the responsibilities of an accountant in a Charitable Trust?

- Apart from satisfying Assessing Officer about the genuineness of activities of trust in the claim for exemption under section 11, he should also work diligently with all the requirements approved by the law.

- The accountant has to check the balance sheet and the profit and loss and give an impression on whether they exhibit an accurate and fair view.

- The accountant must note that the SA’s announced by the ICAI would introduce to the audit of charitable trust under section 12A (1) (b) of the Income Tax Act 1961.

- In matters of professional responsibilities, the accountant should adhere with the “Code of Ethics” published by the ICAI in managing the audit of charitable trust under section 12A(1)(b)

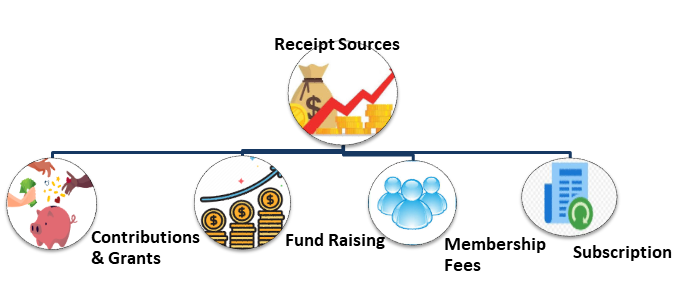

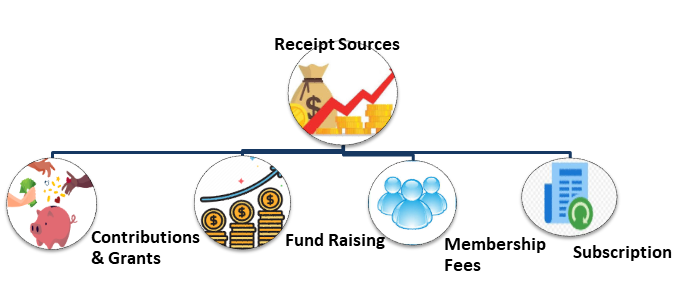

Audit Receipts of Charitable Trust

What do you mean by Requirement for Audit of Charitable Trust?

- Following Clause (b) of sub-section (1) of section 12A of the Income Tax Act[1] , it requires complete audit if the “whole income” of the organization for the appropriate year more than the greatest or maximum amount not liable to income tax.

- It determines that if the organization’s total income in a prior year-before delivering a considerable impact to the provisions of the Act is not more than the said maximum amount, which is not liable to income tax, in that case, no audit is needed.

- It is a prime issue whether any Contributions with a particular direction should form a part of the corpus involved in income.

- The answer is pretty simple. Under the note of guidance determining the ceiling limit of the highest amount, which is not liable to pay income tax for qualification to audit under section 12A (1) (b), donations or grants towards the organization’s corpus are to be added.

- Nevertheless, income exemptions U/s 10, such as all the dividends, should not get combined in the income more than the maximum amount, which is not payable.

- However, during the calculations, if the total income does not seem to surpass the limit of the maximum expense, then it is not chargeable to income tax.

- Despite this, eventually it may appear that the ‘total income’ surpasses the maximum liability may not get subjected to income tax on account of incidents. For example: – if an unforeseen misapplication of the investments designated U/s 11(2) (b), then in such cases, audited reports can get presented with a corrected return, respectively.

- Moreover, the donations collected by an organization whose income is exempt ‘under sections 11 & 12′ or ‘Clause (23’) or ‘Clause (23AA)’ or ‘Clause (23C’) of section 10 of the Act are qualified for deduction under section 80G.

- It should be in considerations only when it has provided after the approval by the Commissioner of Income-tax or Director-General (exemptions) under section ’80G (5) (vi)’.

- In a firm discourse, the primary responsibility of the accountant is required to audit of Charitable Trust as per section 12A, unless there is a particular requirement in the Act/rule/form prescribed. There is no obligation forced upon the accountant to confirm or accredit the compliance given under the provisions of any other law.

- Other than the conditions stated in section 12A (1) (b), the auditor must abide by a few more critical requirements. Section 12A (1) (a) deals with the requirements concerning registration of an organization complying with the Income Tax Act. As a result of this, all the trust registration application has to be furnished in Form No.10A (duplicate), prescribed under Rule 17A of the Act.

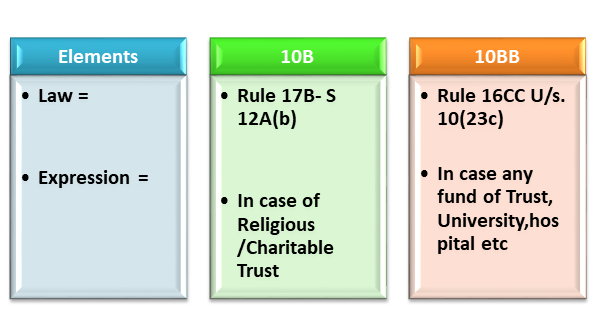

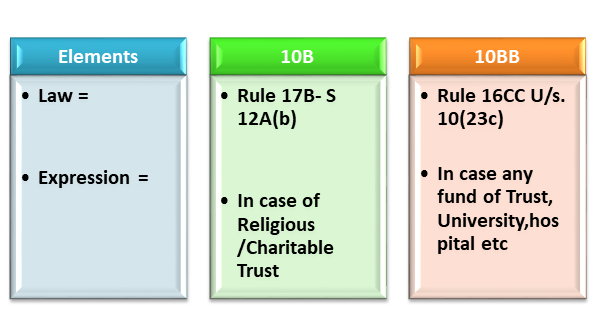

What do you mean by Audit Report under Form 10B and 10BB?

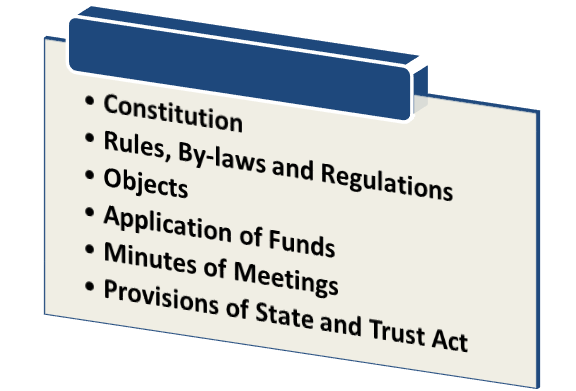

While auditing, the auditor should consider these following documents addressing essential particulars required in the specified annexure form.

- Statements of income and all accounts of expenditure

- Balance sheet of the trust

- All reports for payments and receipts

- Minutes of the meeting of the Trust-Governing committee

- Proof of paid Income Tax-Documents

- Statements of Income Tax-Each year Calculations

- Business reports along with proof of profits and loss

- Numerous copies of the instrument of trust deed/bye-laws/memorandum of articles, etc.

Particulars of FORM 10B- Application of Income

- Whole amount of income per year applied to charitable or religious purpose within India

- Details of income deemed to be used exercised under clause (2) of explanation 11(1)

- Accumulating or setting apart of the revenue for application not more than 15% of income received

- Calculation of the whole amount of income available for exemption u/s 11(1)(c)

- Amount set apart for section 11(2), except section 3

- All the details concerning the amount mentioned in section 5 invested or deposited as per sec 11(2)(b)

- Detailing all the calculation of income in respect of which the option was used earlier year considering the income as of the previous year under section 11(1B)

- Detailing all the income that has accumulated or set apart for stipulated purposes under section 11(2) in an earlier year-

- Determining if the amount that has applied for purposes other than charitable or religious purposes

- Determining if the amount that has ceased to be accumulated or set apart for application

- Determining if the amount that has ceased to remain invested in any agreement referred to in section 11(2)(b)(i)

- Determining if the amount that has invested in any account referred to in section 11(2)(b)(ii) or section 11(2)(b)(iii)

- Determining if the amount has not utilized for objects for which it was accumulated or set apart during the time for collected.

What are the Verifications of Audit of Charitable Trust?

Verification in auditing is a method in which auditors satisfy themselves with the original existence of ‘assets’ and ‘liabilities’ displaying in the Declaration of Financial Position. It examines existence, possession, title, ownership, decent valuation, and appearance of any charge or lien over assets. The Accountant is required to verify:-

- Income as outlined under sections 11 and 12 of the Income-tax Act. It can be divided into five broad classes such as:-

- Income with Direction:- Voluntary contributions made with a specific direction that they shall form part of corpus;

- Income with No Direction:-Voluntary contributions made without a particular direction that they shall form part of corpus;

- Outcomes of Activities:- Profits and gains of business which are incidental for achieving the objects;

- Receipts:– Other customary receipts & Capital gains;

- Check the amount used during that year by separating the figures from:-

- Income and expense account;

- Balance sheet and/or receipts and returns account.

- Examine the donations given to another trust in the name of section 11(3) (d).

- Examine the estimate of services made accessible to the specified class of persons in terms of section 12(2).

- Examinations of anonymous donations concerning the particulars prescribed by the Government. Hence, it would be desirable for the accountant to get proper management representation.

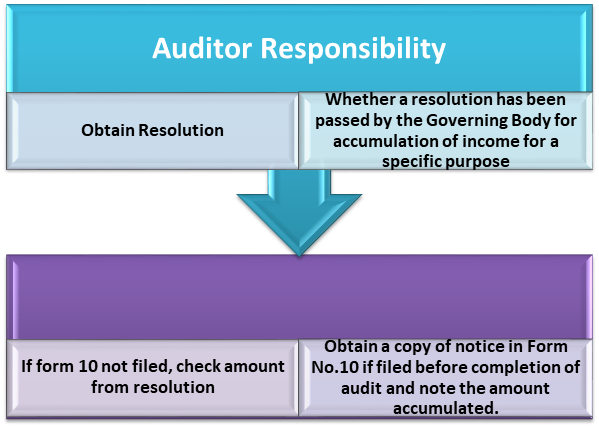

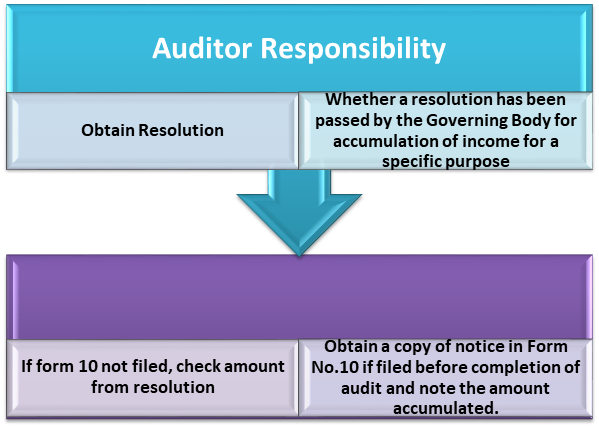

Income Accumulated in Excess of Limit

Section 11(2) implies that where 85% of income has not implemented to be applied to charitable or religious object, however, if accumulated or set apart; such income shall not be inserted to consider the income of the previous year provided:

- Auditor depicts all in the notice given to the assessing officer in a prescribed way, not less than for five years

- Money gets deposited in a specific form and mode which should get specified as per subsection 5.

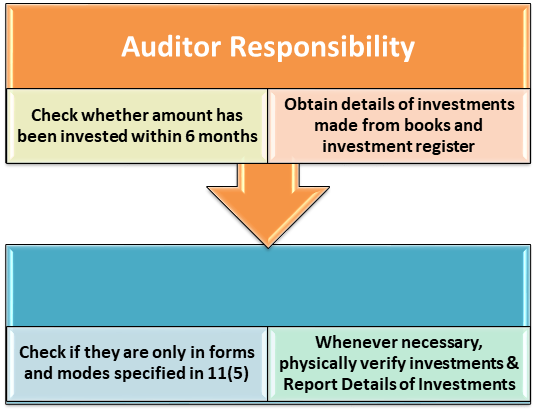

Investment and Deposits in prescribed manner

What is the Credential that Auditor should be Looking while Computing Income?

- Investigate whether any option under the appropriate section had been employed in any earlier years and get management representation to this conclusion;

- Examine whether the option, if executed towards the non-receipt of income or any other reason.

- If the claim is for non-receipt of income, compare with the year of receipt. For the prevailing year, the auditor should examine whether the same amount had taken in the immediately preceding year and if any sum is applied for a charitable missions/purpose;

- If the claim is for any other reason, verify whether the same has been implemented in the current year since the event should have been exercised in the immediately preceding previous year only, and;

- Read the details of such deemed income explicitly stating the appropriate year to which such considered income relates.

Bullets Points covering Expenses

- Payment of Salary, allowances, etc

- Services made Available

- Purchase of Shares, Security or other Property

- Diversion of Income or Property

- Application of Income/Property in any other Manner

- Medical or Educational Services

What are Recent Updates Pertaining to the Audits of Charitable Institutions?

- Audit Report: The Audit Tax Report required filing Tax Audit under section 12A of a trust or institution.

- Time Limit: The Tax Audit Report shall be filed within one month preceding the due date of filing of return under section 139(4A); read with section 139(1).

- Organization should get the accounts audited by the accountant as defined in Description below sub-section (2) of section 288 before the specific date referred to in section 44AB (i.e., one month before the due date for filing of return under sub-section (1) of section 139)

- Furthermore, an amendment of section 92F will present for a due date of filing a tax audit report, which is expected to get accomplished under section 92E.

- Section 43B provides a person to claim certain deductions on a payment basis if the same is paid on or before the due date of filing of return of income.

- Due to this Corona outbreak, the due date for filing of return of income in Tax Audit cases is post-pond to 31st October. Henceforth, Tax Audit Report shall be provided by 30th September positively.

| (I)(B) | Amendment of section 10(23C) | Audit Report cannot be filed along with return of income and shall be filed before the specified date referred to in section 44AB | 01.09.2020 |

| 10(I)(B) | Amendment of section 12A | Audit Report cannot be filed along with return of income and shall be filed before the specified date referred to in section 44AB | 01.09.2020 |

Conclusion

This amendment shall implement from the assessment year 2020-21. It suggests that it will be suitable for the financial year ending on 31st March 2019. Point to be noted that the famous Indian festival Durga Puja and Dussehra are towards October. It is advisable to file income tax return before the joyful season gets lighted. Please check in to our CorpBiz team if you need expert advice on complete assistance for your Audit of Charitable Trust. We will help you to ensure complete Auditing, Accounting, and Compliances as per your desired activities, ensuring the successful and well-timed completion of your work.