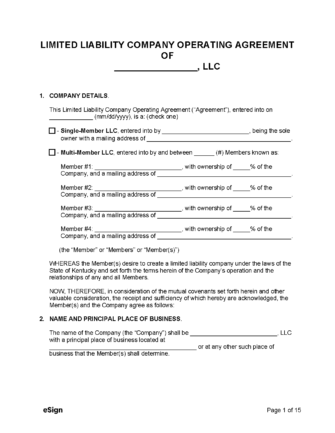

A Kentucky LLC operating agreement is created during the founding of a limited liability company to define its framework, member duties, and operation methods. Entering into an operating agreement means that members agree to comply with the company’s policies, organization, and their responsibilities as owners. Creating an operating agreement is not a legal requirement for entities; however, without one, the members will not be able to customize the internal structure of their business to best suit their needs.

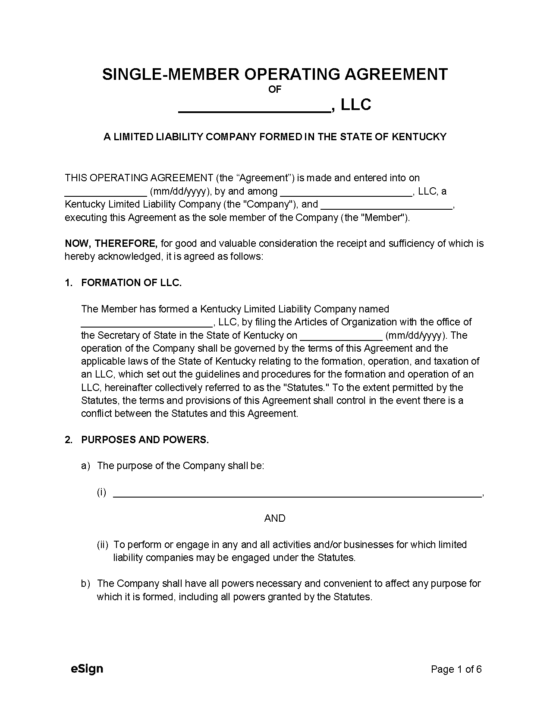

Single-Member – Used for LLCs with a sole owner to outline company operations.

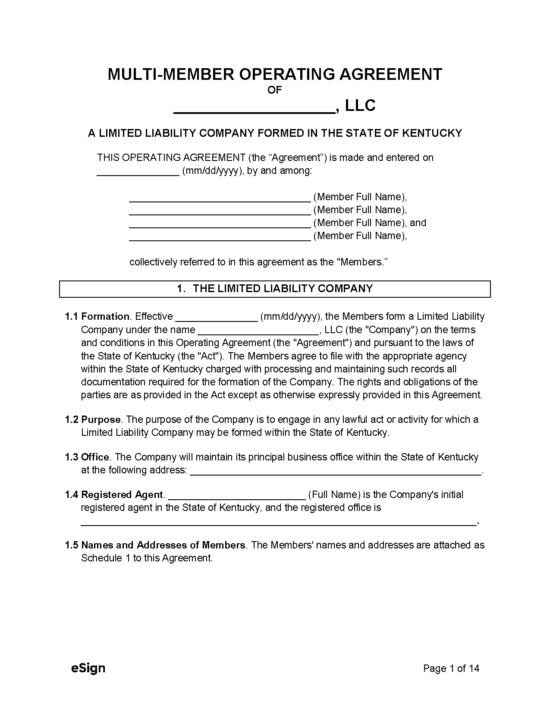

Multi-Member – Used for LLCs with two or more owners to identify company policies and structure.

LLCs must operate with a name that is not already in use by another legal entity in the state. The name must also contain one of the following:

To avoid a rejected registration application with the Secretary of State, LLCs may search their desired name on the Secretary of State Name Availability Search.

Members have the option to reserve a selected name prior to registering their company by mailing the Reservation or Renewal of Reserved Name application (along with the $15 filing fee paid via check) to the following address:

Alison Lundergan Grimes

Office of the Secretary of State

PO Box 718 Frankfort

KY 40602-0718

Once the form has been received, the name will be reserved for up to one hundred and twenty (120) days.

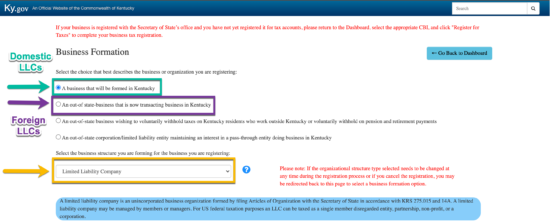

The Articles of Organization (for domestic LLCs) and Certificate of Authority (for foreign LLCs) are the forms that must be submitted to register the company with the state. The application process can be accomplished online or by mail.

Michael Adams

Office of the Secretary of State

P.O. Box 718 Frankfort

KY 40602-0718

Creating an operating agreement will allow LLCs to govern their business’s functional and administrative elements, rather than being governed by the default state rules for LLCs. Once completed, the form can be kept at the LLC registered office and does not need to be filed with the Secretary of State.

An EIN (Employer Identification Number) allows the LLC to be identified as a business and submit tax filings. LLCs with multiple owners are required to apply for an EIN, while LLCs with a sole owner will only need to complete the filing if they intend to hire individuals or file their taxes as a corporation. Applying for an EIN can be done on the IRS website for free.

A printed application (Form SS-4) can be submitted through the postal service instead of completing the online application. The full instructions for completing and delivering the form can be found here.

Filing Options: Online or by Mail

Costs:

Forms:

Links